Recently, market research company Circana (from the merger of IRI and NPD) released the latest data of the US toy market in 2023, revealing the size of the US toy market, consumer trends and best-selling categories.

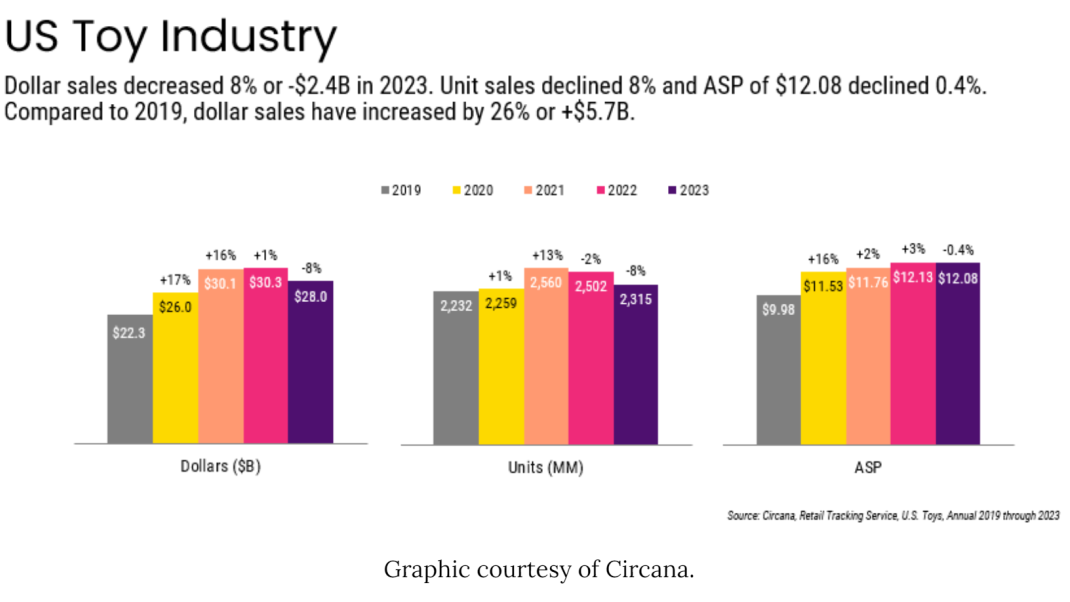

According to some reports the US toy sales continue to be miserable and decreased by 8% last year with the sales amounting around 28 billion dollars. This is the first U.S. sales to fall in two years. US sales of toy units were also down and registered 2.315 Billion units an 8% fall YoY which continues the YoY decline from the previous year selling sprees. The average unit price of a toy was $12.08 and showed no sign of growth in fact it was 0.4 percent lower than before.

Despite the 2023 decline, U.S. toy sales have remained positive for the past four years. Since 2019, total U.S. toy sales have increased by $5.7 billion, driven by growth in average selling prices (ASPs), an average annual growth rate of 6%.

Juli Lennett, vice president and toy industry consultant at Circana, commented that while 2023 will be a challenging year for the U.S. toy industry, the sales growth rate for the past four years is still positive. He also noted that while economic difficulties have affected consumer behavior, the significant purchasing power that has emerged in the past few years cannot be ignored, and that consumer interest in novel products is important to drive continued growth in the toy industry.

Of the 11 toy categories counted by Circana, only three will see growth in 2023. The building blocks category saw the largest increase in sales, with 2023 sales increasing by $220 million, or 8%, over the previous year. Among them, Lego is the biggest winner, including Lego Icons, Lego Disney Classic and Lego Speed Champions are popular.

Sales of soft toys increased by $31 million, or 1%, to rank second. Products driving sales growth in this category include Pokemon, Phoebe, Harry Potter, Sesame Street, Snackles and Cookeez Makery.

Compared to the previous year, car toy sales increased by $6 million, an increase of only 0.3%. The top sellers in the category were Mattel's Hot Wheels toy cars, as well as products related to the "Fast and Furious" and "Teenage Mutant Ninja Turtles" IP.

Notably, outdoor and sports toys were the category with the highest sales decline in 2023, with sales in the category down 16% compared to the previous year.

Overall, the top 10 best-selling toy brands in the United States in 2023 include Pokemon, Barbie, Squishmallows, Star Wars, Marvel, Hot Wheels, Fisher, Lego Star Wars, Disney Princesses and Melissa & Doug.

Lennett added that while consumers will continue to face financial pressure in 2024, they will not give up on buying toys for the important holidays, and toymakers will need to focus on marketing, seasonality, innovation and value for money to be successful this year.